Boris and Kathy's FX Blog www.bktraderfx.com

12/04/2006

Today's Email Alerts

Alert # 2

The Move in the US dollar is Not Over

The two main events this week are Thursday’s ECB rate decision and US non-farm payrolls. The markets could tread water before that, but the possibility would depend upon how service sector ISM fares tomorrow. We know that manufacturing ISM was very bad, but the US economy is dependent on services. Therefore should we get anything other than an in line print in the service sector ISM report, we could see another day of wild price action.

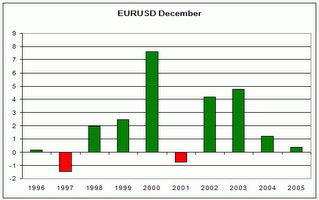

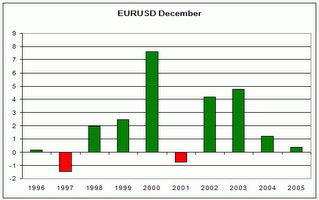

Either way, the move lower in the US dollar could still have more room to run. For those of you who caught our article on DailyFX.com, we pointed out that December tends to be a bearish month for the US dollar. In 15 out of the past 20 years, the US dollar has fallen against the Euro in the month of December (we used the Deutschemark to represent pre Euro). If you zoom into the last 10 years, the statistical significance is even stronger, with the EUR/USD rallying 8 of the past 10 years.

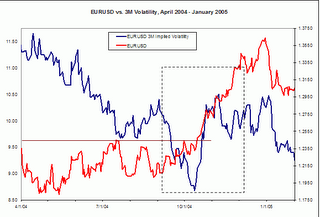

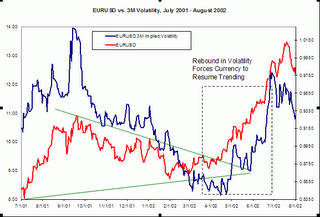

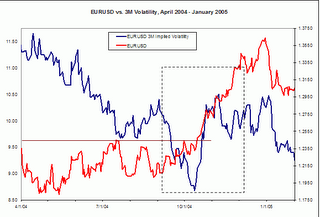

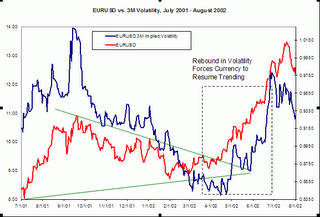

In addition, we performed a study on breakouts after low volatility environments. The last one in 2002 led to a rally in the EUR/USD that was approximately 1250 pips in magnitude over the course of 3 months (see first chart below). The breakout in 2004 was approximately 1100 pips, and that happened over the course of 2.5 months (see second chart below). The breakout that we have seen thus far has only been 500 pips in magnitude which indicates that there is plenty of room to run.

Alert # 1

What will Happen this Week in FX?

Many of you have wondered what’s happened to BKTraderFX signals. Rest assured the signals will be back but have been inordinately busy preparing for FXCM expo next Friday, Saturday and Sunday in Vegas. Since we’ll be on the road this week, our ability to follow markets intensely will be curtailed significantly so we may only be able to send out 1 or 2 signals this week.

Everyone wants to know if this anti-dollar rally continues or not. The greenback is grossly oversold and due for at least a small bounce as evidenced by the bounce tonight. However, only a strong positive surprise in ISM Services or US NFP could turn the sentiment in dollars favor and while NFP are notoriously difficult to handicap the preponderance of evidence suggests that US job growth will be tepid. One other factor could help the dollar this week – surprise “no-hike” announcement from the ECB. How probable is that? Not very. But if the EZ Central bank decided to hold off on tightening until January, the EUR/USD – already doped up like junkie on amphetamine – would fall hard given the market’s near universal anticipation of a hike.

Meanwhile here is an interesting to technically gauge the true strength of the trend.

1. Use hourly charts

2. Lay a long term Simple Moving Average (200 periods)

3. Put on two sets of Bollinger Bands (2 Standard Deviation and 3 Standard Deviation) on the chart.

The currency is in a strong uptrend if the BB bands levitate above the 200 SMA. That’s because the retracements in the currency are so shallow that they never even come close to touching the long term 200 SMA. Furthermore a bounce out of the lower BB band represents a good risk/reward trade to go with the trend.

Alert # 2

The Move in the US dollar is Not Over

The two main events this week are Thursday’s ECB rate decision and US non-farm payrolls. The markets could tread water before that, but the possibility would depend upon how service sector ISM fares tomorrow. We know that manufacturing ISM was very bad, but the US economy is dependent on services. Therefore should we get anything other than an in line print in the service sector ISM report, we could see another day of wild price action.

Either way, the move lower in the US dollar could still have more room to run. For those of you who caught our article on DailyFX.com, we pointed out that December tends to be a bearish month for the US dollar. In 15 out of the past 20 years, the US dollar has fallen against the Euro in the month of December (we used the Deutschemark to represent pre Euro). If you zoom into the last 10 years, the statistical significance is even stronger, with the EUR/USD rallying 8 of the past 10 years.

In addition, we performed a study on breakouts after low volatility environments. The last one in 2002 led to a rally in the EUR/USD that was approximately 1250 pips in magnitude over the course of 3 months (see first chart below). The breakout in 2004 was approximately 1100 pips, and that happened over the course of 2.5 months (see second chart below). The breakout that we have seen thus far has only been 500 pips in magnitude which indicates that there is plenty of room to run.

Alert # 1

What will Happen this Week in FX?

Many of you have wondered what’s happened to BKTraderFX signals. Rest assured the signals will be back but have been inordinately busy preparing for FXCM expo next Friday, Saturday and Sunday in Vegas. Since we’ll be on the road this week, our ability to follow markets intensely will be curtailed significantly so we may only be able to send out 1 or 2 signals this week.

Everyone wants to know if this anti-dollar rally continues or not. The greenback is grossly oversold and due for at least a small bounce as evidenced by the bounce tonight. However, only a strong positive surprise in ISM Services or US NFP could turn the sentiment in dollars favor and while NFP are notoriously difficult to handicap the preponderance of evidence suggests that US job growth will be tepid. One other factor could help the dollar this week – surprise “no-hike” announcement from the ECB. How probable is that? Not very. But if the EZ Central bank decided to hold off on tightening until January, the EUR/USD – already doped up like junkie on amphetamine – would fall hard given the market’s near universal anticipation of a hike.

Meanwhile here is an interesting to technically gauge the true strength of the trend.

1. Use hourly charts

2. Lay a long term Simple Moving Average (200 periods)

3. Put on two sets of Bollinger Bands (2 Standard Deviation and 3 Standard Deviation) on the chart.

The currency is in a strong uptrend if the BB bands levitate above the 200 SMA. That’s because the retracements in the currency are so shallow that they never even come close to touching the long term 200 SMA. Furthermore a bounce out of the lower BB band represents a good risk/reward trade to go with the trend.

But beware! If the BB bands and 200 SMA begin to intersect, no matter what anyone says, the trend is weakening and is quite likely no longer your friend. To see just how fast things can unravel we are attaching the same setup in EUR/USD from January of 2005. Either way, we hope this is some food for thought as the week starts.

Archives

09/2006 10/2006 11/2006 12/2006 01/2007 02/2007 03/2007 04/2007 05/2007 06/2007 07/2007 08/2007 09/2007