Boris and Kathy's FX Blog www.bktraderfx.com

9/28/2006

Today's Email Alerts -

Sign up for our email alerts if you want them instantly!

Comments from the Japanese

Comments by Vice Finance Minister Hideto Fujii today that euro’s appreciation against the yen this year has been a “little rough”, sent USD/JPY and EUR/JPY plunging 30 points within a minute of the news. This is the second time that Japanese officials have used such language to describe EUR/JPY movements and it suggests that the 150 EUR/JPY level represents the “Maginot line” for the pair that world’s central banker do not wish to see crossed. Although USD/JPY managed to regain most of its losses within an hour of the statement yen remains significantly oversold especially against the loonie. Yesterday a jump to $63/bll boosted the Canadian Dollar, but rise may be nothing more than a dead cat bounce fueled by speculation that OPEC may curtail production rather than the fundamental facts that inventories remain near record highs.

Furthermore today traders will be watching Canadian Industrial Production which is expected to contract materially from 1.7% rise the month prior to register no gain. Meanwhile overnight Japan’s Retail Trade data surprised to the upside jumping to 2% fro 1.1% expected providing a positive tone for the unit for the rest of the day. Finally tomorrow’s CPI numbers are all forecast to print much “hotter” than the month prior. So all in all CAD/JPY presents an attractive risk reward trade here with stops no more than 20 points above recent swing highs of 106.00

Sign up for our email alerts if you want them instantly!

Comments from the Japanese

Comments by Vice Finance Minister Hideto Fujii today that euro’s appreciation against the yen this year has been a “little rough”, sent USD/JPY and EUR/JPY plunging 30 points within a minute of the news. This is the second time that Japanese officials have used such language to describe EUR/JPY movements and it suggests that the 150 EUR/JPY level represents the “Maginot line” for the pair that world’s central banker do not wish to see crossed. Although USD/JPY managed to regain most of its losses within an hour of the statement yen remains significantly oversold especially against the loonie. Yesterday a jump to $63/bll boosted the Canadian Dollar, but rise may be nothing more than a dead cat bounce fueled by speculation that OPEC may curtail production rather than the fundamental facts that inventories remain near record highs.

Furthermore today traders will be watching Canadian Industrial Production which is expected to contract materially from 1.7% rise the month prior to register no gain. Meanwhile overnight Japan’s Retail Trade data surprised to the upside jumping to 2% fro 1.1% expected providing a positive tone for the unit for the rest of the day. Finally tomorrow’s CPI numbers are all forecast to print much “hotter” than the month prior. So all in all CAD/JPY presents an attractive risk reward trade here with stops no more than 20 points above recent swing highs of 106.00

9/27/2006

Today's Email Alerts -

Sign up for our email alerts if you want them instantly!

AUD/NZD - Reversal!

The AUD/NZD is giving us a buy signal. A bottom is forming, as the pair manages to hold onto all of yesterday's gains. MACD is also crossing to the upside suggesting that there is momentum behind this turn. As long as we hold above 1.1315, the 9/22 low, we could see the pair reach 1.1530, the 20-day SMA and the 23.6 fibo retracement of the August to September sell-off. Above that, we could see a test of 1.1640, which is the 200-day SMA.

New Home Sales and Durable Goods

Bad news for the dollar - but not enough to cause much action. Technicals and fundamentals call for a continued bounce in the Euro. Prices are stalling at the prior range lows.

CBI Strength May Counteract Blanchard Dovishness

CBI Retail printed at 14 versus 12 to a 21 month high indicating that UK consumer demand remains firm and putting rate hike talk back on the table. EUR/GBP long still looks strong but GBP/CHF short looks considerably more vulnerable in light of weaker than expected KOF earlier today. Rebalance accordingly.

Sign up for our email alerts if you want them instantly!

AUD/NZD - Reversal!

The AUD/NZD is giving us a buy signal. A bottom is forming, as the pair manages to hold onto all of yesterday's gains. MACD is also crossing to the upside suggesting that there is momentum behind this turn. As long as we hold above 1.1315, the 9/22 low, we could see the pair reach 1.1530, the 20-day SMA and the 23.6 fibo retracement of the August to September sell-off. Above that, we could see a test of 1.1640, which is the 200-day SMA.

New Home Sales and Durable Goods

Bad news for the dollar - but not enough to cause much action. Technicals and fundamentals call for a continued bounce in the Euro. Prices are stalling at the prior range lows.

CBI Strength May Counteract Blanchard Dovishness

CBI Retail printed at 14 versus 12 to a 21 month high indicating that UK consumer demand remains firm and putting rate hike talk back on the table. EUR/GBP long still looks strong but GBP/CHF short looks considerably more vulnerable in light of weaker than expected KOF earlier today. Rebalance accordingly.

9/26/2006

Time for a Meltdown in Kiwi

The strong currency is finally catching up to the New Zealand dollar. We had horrid trade numbers last night - the second in a row. Finance Minister Cullen was on the wires late afternoon squashing rate hike expectations. Expressing his sharp distaste for the rise in the kiwi, Cullen said that the upmove was primarily driven by speculative hedge funds and warned that investors should not rule out a drop to 40 cents. Though thats a bit far fetched, his comments that rates could remain unchanged until 2008 are not. Fundamentals call for more weakness in the kiwi as do technicals. The chart below indicates that the NZD/USD's uptrend failed right at prior support turned resistance and a key fibo level. A move to .6425 looks like a possible next step.

The strong currency is finally catching up to the New Zealand dollar. We had horrid trade numbers last night - the second in a row. Finance Minister Cullen was on the wires late afternoon squashing rate hike expectations. Expressing his sharp distaste for the rise in the kiwi, Cullen said that the upmove was primarily driven by speculative hedge funds and warned that investors should not rule out a drop to 40 cents. Though thats a bit far fetched, his comments that rates could remain unchanged until 2008 are not. Fundamentals call for more weakness in the kiwi as do technicals. The chart below indicates that the NZD/USD's uptrend failed right at prior support turned resistance and a key fibo level. A move to .6425 looks like a possible next step.

9/25/2006

Fundamentals, Technicals, and Sentiment Point to Near Term Dollar Strength

Although we are long term dollar bears, we cant help but acknowledge how dollar bullish the market is at the moment. And they have good reason to be for fundamental, technical and sentiment reasons.

Fundamental - Oil prices are presently breaking below $60 a barrel - something we haven't seen since March. As we all know, lower oil could lead to increased consumer confidence which will help to keep retail sales relatively steady. Increased supply, cooling geopolitical tensions and a quiet hurricane season are all reasons that have been given to explain the slide in oil. We think there is more in this move since the Amaranth loss will cause more hedge funds to reevaluate their holdings. The lower oil goes, the better it is for the US dollar, at least for the time being.

Technicals - Range trading remains the predominant theme in the Euro and right now, the currency is setting up for a test of the lower band of the range at 1.2625/50. Yesterday's candle was a cross between a doji and shooting star with the failure happening at the key 61.8% fibo of 1.2938-1.2630 range. Today's candle has opened with both a lower high and low, which signals the potential for further weakness. This indicates that we could continue to see more dollar strength, at least until 1.2650 against the US dollar.

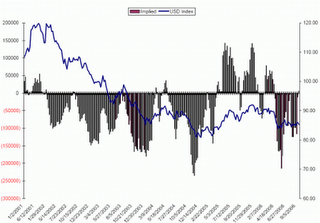

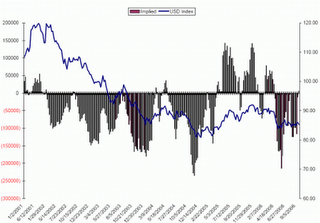

Sentiment - Sentiment is also favoring more dollar strength. Our technical analyst at dailyfx.com, Jamie Saettle made a great observation on this week's COT report. For the first time since last April, implied US dollar positioning flipped from net short to long. The chart below illustrates the tendency of the US dollar to follow the direction of speculative positioning. He points out the importance of the turn at implied positioning extremes as well as the follow through moves that typically occur following the implied positioning indicator flip to negative or positive.

It is rare that we see fundamentals, technicals and sentiment aligned - and when we do, it can be a strong and telling signal.

Although we are long term dollar bears, we cant help but acknowledge how dollar bullish the market is at the moment. And they have good reason to be for fundamental, technical and sentiment reasons.

Fundamental - Oil prices are presently breaking below $60 a barrel - something we haven't seen since March. As we all know, lower oil could lead to increased consumer confidence which will help to keep retail sales relatively steady. Increased supply, cooling geopolitical tensions and a quiet hurricane season are all reasons that have been given to explain the slide in oil. We think there is more in this move since the Amaranth loss will cause more hedge funds to reevaluate their holdings. The lower oil goes, the better it is for the US dollar, at least for the time being.

Technicals - Range trading remains the predominant theme in the Euro and right now, the currency is setting up for a test of the lower band of the range at 1.2625/50. Yesterday's candle was a cross between a doji and shooting star with the failure happening at the key 61.8% fibo of 1.2938-1.2630 range. Today's candle has opened with both a lower high and low, which signals the potential for further weakness. This indicates that we could continue to see more dollar strength, at least until 1.2650 against the US dollar.

Sentiment - Sentiment is also favoring more dollar strength. Our technical analyst at dailyfx.com, Jamie Saettle made a great observation on this week's COT report. For the first time since last April, implied US dollar positioning flipped from net short to long. The chart below illustrates the tendency of the US dollar to follow the direction of speculative positioning. He points out the importance of the turn at implied positioning extremes as well as the follow through moves that typically occur following the implied positioning indicator flip to negative or positive.

It is rare that we see fundamentals, technicals and sentiment aligned - and when we do, it can be a strong and telling signal.

9/20/2006

Welcome!

Welcome to our brand new currency blog! As leading analysts within the foreign exchange market, we are always looking for new ways to reach out to our audience. The benefit of working in a trading team has allowed us to filter out the best trade ideas. In this blog, each week we will be reviewing the current conditions in the currency market on both a fundamental and technical basis in a more free speaking format. We will bring the strategies in our 3 books to life and will also be posting any ideas that we may have, articles that we find interesting and our takes on key economic and geopolitical news. If you want more, sign up for our instant alerts!

- Kathy and Boris

- Kathy and Boris

Archives

09/2006 10/2006 11/2006 12/2006 01/2007 02/2007 03/2007 04/2007 05/2007 06/2007 07/2007 08/2007 09/2007