Boris and Kathy's FX Blog www.bktraderfx.com

12/31/2006

Introduction of Premium Service

We wanted to remind you that starting January 2nd, we will be emailing our trading alerts exclusively through our new service BKForexadvisor.com End of week updates will be posted on BKTraderFX.com

In conjunction with our partner Investopedia, the premier financial education portal in the world we would like to invite you to join our exclusive trading community.

Through this new advisory service we will communicate with you everyday. So not only will you receive the same high quality high probability trading recommendations that you have seen over the past 2 months, but we will also provide you with our latest trading strategies, tips on psychology and money management and other useful commentary about foreign exchange - a market that offers great trades nearly every day of the year.

We want you to be completely satisfied with the product. Therefore we are offering a 100% money back guarantee, no questions asked. If you are not thrilled with the service just let us know within the first 30 days and we won't bill your credit card. That means you get to continue to sample our service until the end of January with full, un-restricted access absolutely risk free. A credit card is required to activate your free trial but you will never be charged during your free trial period, and you can cancel at any time.

All you need to do is register at: http://www.bkforexadvisor.com/

If you sign-up for a 30-day free trial right now you can lock-in the introductory rate of only $995 annually or $295 quarterly which equates to a little over $82 per month.

Feel free to email us if you have any questions. Starting January 2nd, 2007 we will be sending out emails and trade recommendations exclusively to those who have registered for the free trial on www.bkforexadvisor.com.

We wanted to remind you that starting January 2nd, we will be emailing our trading alerts exclusively through our new service BKForexadvisor.com End of week updates will be posted on BKTraderFX.com

In conjunction with our partner Investopedia, the premier financial education portal in the world we would like to invite you to join our exclusive trading community.

Through this new advisory service we will communicate with you everyday. So not only will you receive the same high quality high probability trading recommendations that you have seen over the past 2 months, but we will also provide you with our latest trading strategies, tips on psychology and money management and other useful commentary about foreign exchange - a market that offers great trades nearly every day of the year.

We want you to be completely satisfied with the product. Therefore we are offering a 100% money back guarantee, no questions asked. If you are not thrilled with the service just let us know within the first 30 days and we won't bill your credit card. That means you get to continue to sample our service until the end of January with full, un-restricted access absolutely risk free. A credit card is required to activate your free trial but you will never be charged during your free trial period, and you can cancel at any time.

All you need to do is register at: http://www.bkforexadvisor.com/

If you sign-up for a 30-day free trial right now you can lock-in the introductory rate of only $995 annually or $295 quarterly which equates to a little over $82 per month.

Feel free to email us if you have any questions. Starting January 2nd, 2007 we will be sending out emails and trade recommendations exclusively to those who have registered for the free trial on www.bkforexadvisor.com.

12/28/2006

Today's Email Alert:

To our frustration, USD/JPY moved 6 pips above our stop, reversed and is now heading lower. Unfortunately in thin market conditions, it is tough to get exact levels right. However, we only risked a small 25 pips on this trade and will be looking for the next best opportunity

To our frustration, USD/JPY moved 6 pips above our stop, reversed and is now heading lower. Unfortunately in thin market conditions, it is tough to get exact levels right. However, we only risked a small 25 pips on this trade and will be looking for the next best opportunity

12/27/2006

Today's Email Alerts:

Alert # 1 Getting Short USD/JPY

Welcome back to Carry Trade Unwinding! Overnight the JiJi news agency reported that the Bank of Japan will be weighing the possibility of a 25bp or 50bp rate hike in January. Although this is pure speculation, the market is already pricing in a 70 percent chance for a January hike. It is unlikely traders will want to be short Yen going into the meeting. Furthermore, the UAE central bank announced this morning that they plan on diversifying out of US dollars into Euros. There is widespread belief that many other Middle East central banks are increasing their holdings of Euros, British Pounds and Japanese Yen.

Therefore So we want to go short USD/JPY at market (Currently 118.65 ) Stop 118.90 T1 is 118.40 T2 is 117.87. As usual, once our first target (T1) is reached, move your stop to breakeven on the second lot.

Alert # 1 Getting Short USD/JPY

Welcome back to Carry Trade Unwinding! Overnight the JiJi news agency reported that the Bank of Japan will be weighing the possibility of a 25bp or 50bp rate hike in January. Although this is pure speculation, the market is already pricing in a 70 percent chance for a January hike. It is unlikely traders will want to be short Yen going into the meeting. Furthermore, the UAE central bank announced this morning that they plan on diversifying out of US dollars into Euros. There is widespread belief that many other Middle East central banks are increasing their holdings of Euros, British Pounds and Japanese Yen.

Therefore So we want to go short USD/JPY at market (Currently 118.65 ) Stop 118.90 T1 is 118.40 T2 is 117.87. As usual, once our first target (T1) is reached, move your stop to breakeven on the second lot.

12/22/2006

Today's Email Alerts:

Alert # 2 Sidelined after EUR/CHF spike

The spike in EUR/CHF after release of 8:30 US data took us out at brekeven at 1.6033 on the second half of our position. We remain sidelined after banking +15 on the trade.

Alert #1 Taking T1 Short EUR/CHF at Market

EUR/CHF has finally started to move our way so we are going to take T1 at market (currently 1.6018) to bank +15 and will move to breakeven on the rest targeting 1.5987 on T2

Alert # 2 Sidelined after EUR/CHF spike

The spike in EUR/CHF after release of 8:30 US data took us out at brekeven at 1.6033 on the second half of our position. We remain sidelined after banking +15 on the trade.

Alert #1 Taking T1 Short EUR/CHF at Market

EUR/CHF has finally started to move our way so we are going to take T1 at market (currently 1.6018) to bank +15 and will move to breakeven on the rest targeting 1.5987 on T2

12/21/2006

Today's Email Alerts:

Alert # 1 Getting Short EUR/CHF

EUR/CHF has made 9 consecutive green candles on the daily chart more than fulfilling our 7 day extension fade setup. We have been very patient to wait for a sign of exhaustion before getting in because EUR/CHF has previously seen exhaustion moves that have lasted for nine days. Such exuberance in the pair naturally leads to a retracement and thats what we want to trade on.

So we want to go short EUR/CHF (Currently 1.6033 ) Stop 1.6060 T1 is 1.6013. Once the first target is reached, move your stop to breakeven, T2 is 1.5987

Alert # 1 Getting Short EUR/CHF

EUR/CHF has made 9 consecutive green candles on the daily chart more than fulfilling our 7 day extension fade setup. We have been very patient to wait for a sign of exhaustion before getting in because EUR/CHF has previously seen exhaustion moves that have lasted for nine days. Such exuberance in the pair naturally leads to a retracement and thats what we want to trade on.

So we want to go short EUR/CHF (Currently 1.6033 ) Stop 1.6060 T1 is 1.6013. Once the first target is reached, move your stop to breakeven, T2 is 1.5987

12/20/2006

Today's Email Alerts:

Alert #2 Short USD/CAD T1 Banked

AHHHHHHHH!!!! Do you sometimes want to just scream in frustration? Welcome to trading. We banked our T1 in short USD/CAD at 1.1503 early this morning for +20 and moved the stop to breakeven only to be tagged out by 1 pip and then see the pair collapse another 60 points lower. Alas that's trading. There will be hundreds probably thousands more trades in our lifetime but if we abandon our discipline of never letting a winner turn into a loser we may not be around to enjoy them. In any case for those of you still in the trade take T2 at market (currently 1.1463) for a nice +80 on this trade. As for us we are taking our +20 and moving on.

Alert #1 Taking T1 on Short USD/CAD

USD/CAD finally collapsed to our T1 target in very thin markets in a matter of seconds ( hey sometimes its good to be on the right side of liquidity :) We took T1 at 1.1503 banking (+20) and now go to breakeven targeting T2 at 1.1435. Stay Tuned.

Alert #2 Short USD/CAD T1 Banked

AHHHHHHHH!!!! Do you sometimes want to just scream in frustration? Welcome to trading. We banked our T1 in short USD/CAD at 1.1503 early this morning for +20 and moved the stop to breakeven only to be tagged out by 1 pip and then see the pair collapse another 60 points lower. Alas that's trading. There will be hundreds probably thousands more trades in our lifetime but if we abandon our discipline of never letting a winner turn into a loser we may not be around to enjoy them. In any case for those of you still in the trade take T2 at market (currently 1.1463) for a nice +80 on this trade. As for us we are taking our +20 and moving on.

Alert #1 Taking T1 on Short USD/CAD

USD/CAD finally collapsed to our T1 target in very thin markets in a matter of seconds ( hey sometimes its good to be on the right side of liquidity :) We took T1 at 1.1503 banking (+20) and now go to breakeven targeting T2 at 1.1435. Stay Tuned.

12/19/2006

Today's Email Alerts:

Alert # 1 Selling USD/CAD

We are looking to short USD/CAD today, as it looks good from multiple time frames. Oil prices have reversed this morning's drop as weather here in NY begins to fall from the 50s down to the low 40s. Technically, we are seeing a turn on the daily charts below our favored first standard deviation bollinger band. On the hourly charts, we have confirmation of a short term trend reversal with prices below the 200-hour SMA.

Therefore we are looking to short USD/CAD at market (it is currently trading at 1.1523), with a stop at 1.1553. Our first target is 1.1503, second target is 1.1435.

Alert # 1 Selling USD/CAD

We are looking to short USD/CAD today, as it looks good from multiple time frames. Oil prices have reversed this morning's drop as weather here in NY begins to fall from the 50s down to the low 40s. Technically, we are seeing a turn on the daily charts below our favored first standard deviation bollinger band. On the hourly charts, we have confirmation of a short term trend reversal with prices below the 200-hour SMA.

Therefore we are looking to short USD/CAD at market (it is currently trading at 1.1523), with a stop at 1.1553. Our first target is 1.1503, second target is 1.1435.

12/05/2006

Today's Email Alert:

High Probability Setup

We are off to Vegas and hope to see some of you there this week-end. As you can imagine we’ve been very busy and haven’t had much chance to trade. We’ll be back at our desks next week and hope to start sending you trade ideas again.

In the meantime lets take a look at something we were watching today – which is one of our favorite setups because it is such a high probability trade. The funda retrace setup.

See Chart

Overnight we had very positive news on the yen as a slew of Japanese officials commented on the possibility of December rather than January hike. This was big news. In fact one of the key to understanding the yen is that the currency trades much more on official commentary rather than economic data. That’s why so many traders – both technical and fundamental have such a hard time handicapping the unit. It doesn’t follow logic – it follows rhetoric.

In any event the overnight news caused a major move down. But how to trade it? Especially if you only came into the market during the US session and were afraid of bottom ticking the pair. Enter one of our favorite setups – the funda retrace. With fundamental news at our back we waited patiently for the pair to bounce. It did, after the better than expected ISM Services. At this point however, we let the technicals do the talking. We had a buy bias on the yen – but weren’t about to guess the turn. Instead we waited for counter trend move to exhaust itself on the hourlies. At 1 PM EST (18:00 GMT) the pair finally printed a red candle. Going short on the close would have gotten you into the trade at 115.00. Risk was to 115.40 because if the pair had rallied that far up chances were that the market turned pro-dollar once again speculating that US data would be positive rest of the week. Looking at the chart you can see that we would have made our T1 at 114.80. Whether the trade makes it to T2 near the day’s lows remains to be seen. But as a high probability low risk setup – the funda retrace is one of our favorite trades. The key however is to let the price action govern your entry rather than blindly following your directional bias.

High Probability Setup

We are off to Vegas and hope to see some of you there this week-end. As you can imagine we’ve been very busy and haven’t had much chance to trade. We’ll be back at our desks next week and hope to start sending you trade ideas again.

In the meantime lets take a look at something we were watching today – which is one of our favorite setups because it is such a high probability trade. The funda retrace setup.

See Chart

Overnight we had very positive news on the yen as a slew of Japanese officials commented on the possibility of December rather than January hike. This was big news. In fact one of the key to understanding the yen is that the currency trades much more on official commentary rather than economic data. That’s why so many traders – both technical and fundamental have such a hard time handicapping the unit. It doesn’t follow logic – it follows rhetoric.

In any event the overnight news caused a major move down. But how to trade it? Especially if you only came into the market during the US session and were afraid of bottom ticking the pair. Enter one of our favorite setups – the funda retrace. With fundamental news at our back we waited patiently for the pair to bounce. It did, after the better than expected ISM Services. At this point however, we let the technicals do the talking. We had a buy bias on the yen – but weren’t about to guess the turn. Instead we waited for counter trend move to exhaust itself on the hourlies. At 1 PM EST (18:00 GMT) the pair finally printed a red candle. Going short on the close would have gotten you into the trade at 115.00. Risk was to 115.40 because if the pair had rallied that far up chances were that the market turned pro-dollar once again speculating that US data would be positive rest of the week. Looking at the chart you can see that we would have made our T1 at 114.80. Whether the trade makes it to T2 near the day’s lows remains to be seen. But as a high probability low risk setup – the funda retrace is one of our favorite trades. The key however is to let the price action govern your entry rather than blindly following your directional bias.

12/04/2006

Today's Email Alerts

Alert # 2

The Move in the US dollar is Not Over

The two main events this week are Thursday’s ECB rate decision and US non-farm payrolls. The markets could tread water before that, but the possibility would depend upon how service sector ISM fares tomorrow. We know that manufacturing ISM was very bad, but the US economy is dependent on services. Therefore should we get anything other than an in line print in the service sector ISM report, we could see another day of wild price action.

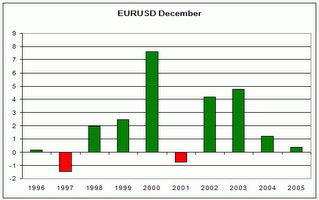

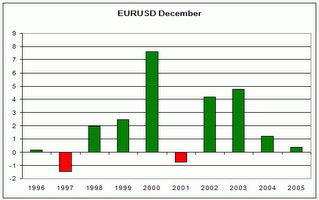

Either way, the move lower in the US dollar could still have more room to run. For those of you who caught our article on DailyFX.com, we pointed out that December tends to be a bearish month for the US dollar. In 15 out of the past 20 years, the US dollar has fallen against the Euro in the month of December (we used the Deutschemark to represent pre Euro). If you zoom into the last 10 years, the statistical significance is even stronger, with the EUR/USD rallying 8 of the past 10 years.

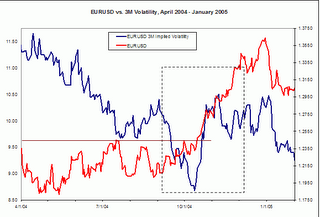

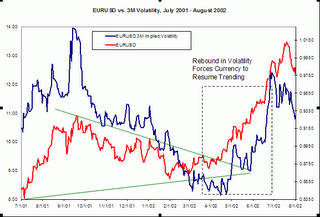

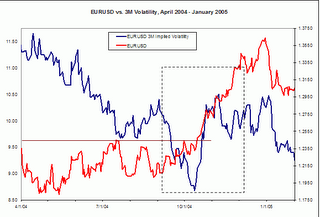

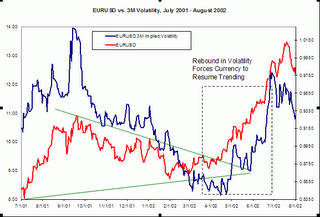

In addition, we performed a study on breakouts after low volatility environments. The last one in 2002 led to a rally in the EUR/USD that was approximately 1250 pips in magnitude over the course of 3 months (see first chart below). The breakout in 2004 was approximately 1100 pips, and that happened over the course of 2.5 months (see second chart below). The breakout that we have seen thus far has only been 500 pips in magnitude which indicates that there is plenty of room to run.

Alert # 1

What will Happen this Week in FX?

Many of you have wondered what’s happened to BKTraderFX signals. Rest assured the signals will be back but have been inordinately busy preparing for FXCM expo next Friday, Saturday and Sunday in Vegas. Since we’ll be on the road this week, our ability to follow markets intensely will be curtailed significantly so we may only be able to send out 1 or 2 signals this week.

Everyone wants to know if this anti-dollar rally continues or not. The greenback is grossly oversold and due for at least a small bounce as evidenced by the bounce tonight. However, only a strong positive surprise in ISM Services or US NFP could turn the sentiment in dollars favor and while NFP are notoriously difficult to handicap the preponderance of evidence suggests that US job growth will be tepid. One other factor could help the dollar this week – surprise “no-hike” announcement from the ECB. How probable is that? Not very. But if the EZ Central bank decided to hold off on tightening until January, the EUR/USD – already doped up like junkie on amphetamine – would fall hard given the market’s near universal anticipation of a hike.

Meanwhile here is an interesting to technically gauge the true strength of the trend.

1. Use hourly charts

2. Lay a long term Simple Moving Average (200 periods)

3. Put on two sets of Bollinger Bands (2 Standard Deviation and 3 Standard Deviation) on the chart.

The currency is in a strong uptrend if the BB bands levitate above the 200 SMA. That’s because the retracements in the currency are so shallow that they never even come close to touching the long term 200 SMA. Furthermore a bounce out of the lower BB band represents a good risk/reward trade to go with the trend.

Alert # 2

The Move in the US dollar is Not Over

The two main events this week are Thursday’s ECB rate decision and US non-farm payrolls. The markets could tread water before that, but the possibility would depend upon how service sector ISM fares tomorrow. We know that manufacturing ISM was very bad, but the US economy is dependent on services. Therefore should we get anything other than an in line print in the service sector ISM report, we could see another day of wild price action.

Either way, the move lower in the US dollar could still have more room to run. For those of you who caught our article on DailyFX.com, we pointed out that December tends to be a bearish month for the US dollar. In 15 out of the past 20 years, the US dollar has fallen against the Euro in the month of December (we used the Deutschemark to represent pre Euro). If you zoom into the last 10 years, the statistical significance is even stronger, with the EUR/USD rallying 8 of the past 10 years.

In addition, we performed a study on breakouts after low volatility environments. The last one in 2002 led to a rally in the EUR/USD that was approximately 1250 pips in magnitude over the course of 3 months (see first chart below). The breakout in 2004 was approximately 1100 pips, and that happened over the course of 2.5 months (see second chart below). The breakout that we have seen thus far has only been 500 pips in magnitude which indicates that there is plenty of room to run.

Alert # 1

What will Happen this Week in FX?

Many of you have wondered what’s happened to BKTraderFX signals. Rest assured the signals will be back but have been inordinately busy preparing for FXCM expo next Friday, Saturday and Sunday in Vegas. Since we’ll be on the road this week, our ability to follow markets intensely will be curtailed significantly so we may only be able to send out 1 or 2 signals this week.

Everyone wants to know if this anti-dollar rally continues or not. The greenback is grossly oversold and due for at least a small bounce as evidenced by the bounce tonight. However, only a strong positive surprise in ISM Services or US NFP could turn the sentiment in dollars favor and while NFP are notoriously difficult to handicap the preponderance of evidence suggests that US job growth will be tepid. One other factor could help the dollar this week – surprise “no-hike” announcement from the ECB. How probable is that? Not very. But if the EZ Central bank decided to hold off on tightening until January, the EUR/USD – already doped up like junkie on amphetamine – would fall hard given the market’s near universal anticipation of a hike.

Meanwhile here is an interesting to technically gauge the true strength of the trend.

1. Use hourly charts

2. Lay a long term Simple Moving Average (200 periods)

3. Put on two sets of Bollinger Bands (2 Standard Deviation and 3 Standard Deviation) on the chart.

The currency is in a strong uptrend if the BB bands levitate above the 200 SMA. That’s because the retracements in the currency are so shallow that they never even come close to touching the long term 200 SMA. Furthermore a bounce out of the lower BB band represents a good risk/reward trade to go with the trend.

But beware! If the BB bands and 200 SMA begin to intersect, no matter what anyone says, the trend is weakening and is quite likely no longer your friend. To see just how fast things can unravel we are attaching the same setup in EUR/USD from January of 2005. Either way, we hope this is some food for thought as the week starts.

Archives

09/2006 10/2006 11/2006 12/2006 01/2007 02/2007 03/2007 04/2007 05/2007 06/2007 07/2007 08/2007 09/2007