Boris and Kathy's FX Blog www.bktraderfx.com

9/25/2006

Fundamentals, Technicals, and Sentiment Point to Near Term Dollar Strength

Although we are long term dollar bears, we cant help but acknowledge how dollar bullish the market is at the moment. And they have good reason to be for fundamental, technical and sentiment reasons.

Fundamental - Oil prices are presently breaking below $60 a barrel - something we haven't seen since March. As we all know, lower oil could lead to increased consumer confidence which will help to keep retail sales relatively steady. Increased supply, cooling geopolitical tensions and a quiet hurricane season are all reasons that have been given to explain the slide in oil. We think there is more in this move since the Amaranth loss will cause more hedge funds to reevaluate their holdings. The lower oil goes, the better it is for the US dollar, at least for the time being.

Technicals - Range trading remains the predominant theme in the Euro and right now, the currency is setting up for a test of the lower band of the range at 1.2625/50. Yesterday's candle was a cross between a doji and shooting star with the failure happening at the key 61.8% fibo of 1.2938-1.2630 range. Today's candle has opened with both a lower high and low, which signals the potential for further weakness. This indicates that we could continue to see more dollar strength, at least until 1.2650 against the US dollar.

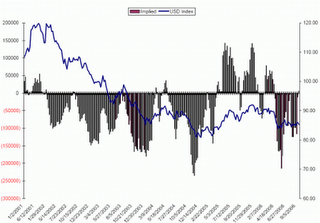

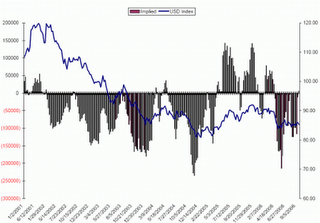

Sentiment - Sentiment is also favoring more dollar strength. Our technical analyst at dailyfx.com, Jamie Saettle made a great observation on this week's COT report. For the first time since last April, implied US dollar positioning flipped from net short to long. The chart below illustrates the tendency of the US dollar to follow the direction of speculative positioning. He points out the importance of the turn at implied positioning extremes as well as the follow through moves that typically occur following the implied positioning indicator flip to negative or positive.

It is rare that we see fundamentals, technicals and sentiment aligned - and when we do, it can be a strong and telling signal.

Although we are long term dollar bears, we cant help but acknowledge how dollar bullish the market is at the moment. And they have good reason to be for fundamental, technical and sentiment reasons.

Fundamental - Oil prices are presently breaking below $60 a barrel - something we haven't seen since March. As we all know, lower oil could lead to increased consumer confidence which will help to keep retail sales relatively steady. Increased supply, cooling geopolitical tensions and a quiet hurricane season are all reasons that have been given to explain the slide in oil. We think there is more in this move since the Amaranth loss will cause more hedge funds to reevaluate their holdings. The lower oil goes, the better it is for the US dollar, at least for the time being.

Technicals - Range trading remains the predominant theme in the Euro and right now, the currency is setting up for a test of the lower band of the range at 1.2625/50. Yesterday's candle was a cross between a doji and shooting star with the failure happening at the key 61.8% fibo of 1.2938-1.2630 range. Today's candle has opened with both a lower high and low, which signals the potential for further weakness. This indicates that we could continue to see more dollar strength, at least until 1.2650 against the US dollar.

Sentiment - Sentiment is also favoring more dollar strength. Our technical analyst at dailyfx.com, Jamie Saettle made a great observation on this week's COT report. For the first time since last April, implied US dollar positioning flipped from net short to long. The chart below illustrates the tendency of the US dollar to follow the direction of speculative positioning. He points out the importance of the turn at implied positioning extremes as well as the follow through moves that typically occur following the implied positioning indicator flip to negative or positive.

It is rare that we see fundamentals, technicals and sentiment aligned - and when we do, it can be a strong and telling signal.

Archives

09/2006 10/2006 11/2006 12/2006 01/2007 02/2007 03/2007 04/2007 05/2007 06/2007 07/2007 08/2007 09/2007